Nigeria Dominates List of 100 Most-Funded African Startups

No fewer than 27 Nigerian startups are among the Most Funded African startups, according to a list curated by Digest Africa, a data and intelligence company based in Uganda. According to the report,...

No fewer than 27 Nigerian startups are among the Most Funded African startups, according to a list curated by Digest Africa, a data and intelligence company based in Uganda.

Table Of Content

According to the report, the 100 most funded African startups have raised $10 billion across 436 deals, representing an average of $23 million per deal, a relatively low figure compared with California-based e-cigarette company JUUL Labs has raised $15 billion alone in disclosed funding.

Recall we recently reported that venture funding in Africa surprisingly dropped by 54% in the third quarter of the year, per data from CB Insights.

A total of 13 African countries are represented on the list, with Nigeria leading the pack with 27 startups, followed closely by Kenya with 23. The other two members of the Big 4 — South Africa and Egypt — are represented by 19 and 15 startups, respectively, which means the big 4 accounts for 84% of the 100 startups.

Trailing behind is Ghana, with five startups, followed by Uganda and Tunisia, with three and two startups, respectively. The remaining countries — Algeria, Congo, Malawi, Tanzania, Senegal and Mauritius — can boast of just one startup each.

Sectoral breakdown

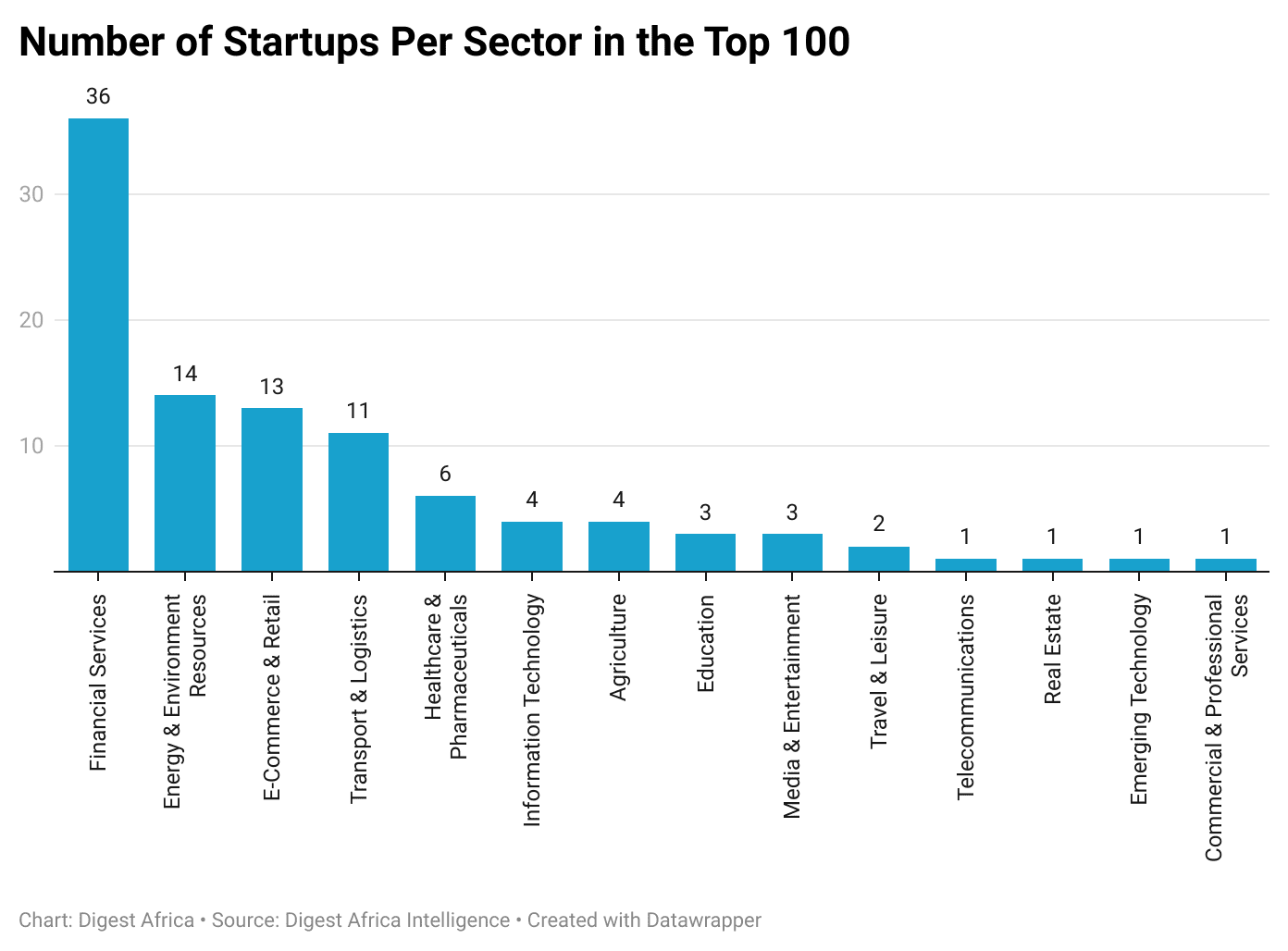

On a sector basis, 36 of the most funded African startups were fintech companies, which is more than twice the next sector, energy and environment resources.

In total, 14 sectors were represented in the top 100.

Apart from those mentioned above, the other sectors include e-commerce & retail, transport & logistics, healthcare & pharmaceuticals, information technology, agriculture, education, media & entertainment, travel & leisure, telecommunications, real estate, emerging technology and commercial & professional services.

That African startups under financial services are topping the list is expected. The continent’s fintech sector is booming thanks to venture capital funding and the rising adoption of digital financial services.

According to global management consulting firm McKinsey, the financial-services market could reach about $230 billion in revenues by 2025.

Jumia is the most funded startup

According to the report, the most funded African startup is e-commerce giant Jumia which raised $885 million across six funding rounds in seven years.

Jumia kicked off its funding journey in 2012 — the year it was established — drawing $45 million Series A from Blakeney Management, Rocket Internet and Millicom Systems. The following year, the company raised $150 million in Series B.

In 2014, Jumia raised another $150 million in new funding. Another standout funding round was a $400m Series C in March 2016 from Rocket Internet, MTN Group, Orange, Goldman Sachs, CDC Group and AXA Group. In 2018, French spirits group Pernod Ricard bought a stake said to be worth $84.4 million in Jumia.

Finally, in April 2019, the e-commerce giant drew a $56 million investment from Mastercard Inc. The same month, Jumia got listed on the New York Stock Exchange (NYSE).

Despite the interesting numbers, the journey hasn’t been particularly smooth for Jumia. From market challenges to dwindling revenues, the e-commerce giant has its fair share of struggles.

For instance, the “Amazon of Africa” was forced to close shop in Cameroon in 2019, indicating that the company appears to be losing its grip on African markets. Since its inception in 2012, Jumia has reportedly accumulated over $1 billion in losses.

Nigeria dominates as usual

Unsurprisingly, Nigeria dominates the list of 100 most-funded African startups. In the past decade, Nigeria has remained Africa’s leading tech hub on the continent, birthing many successful startups on the continent, including unicorns. According to a recent report, 383 tech startups in Nigeria raised a combined US$2 billion in the last 7 years, a higher total than any other country.

Listed below are the 27 Nigerian startups that made the list of most-funded African startups released by Digest Africa.

| S/N | Name | Sector | Number of funding rounds | Total funding raised (USD) |

| 1. | Jumia Group | E-commerce & Retail | 6 | 885,4oo,ooo |

| 2. | Opay | Financial Services | 3 | 570,000,000 |

| 3. | Flutterwave | Financial Services | 8 | 475,530,000 |

| 4. | Andela | Commercial & Professional Services | 6 | 381,000,000 |

| 5. | Interswitch | Financial Services | 3 | 310,000,000 |

| 6. | Moove | Financial Services | 6 | 178,000,000 |

| 7. | Trade Depot | E-commerce & Retail | 4 | 123,000,000 |

| 8. | Lumos Global | Energy & Environment Resources | 3 | 122,000,000 |

| 9. | Kudabank | Financial Services | 5 | 91,617,000 |

| 10. | Konga | E-commerce & Retail | 4 | 79,500,000 |

| 11. | Thrive Agric | Agriculture | 8 | 58,560,000 |

| 12. | Yellow Card | Financial Services | 3 | 56,500,000 |

| 13. | Fairmoney | Financial Services | 4 | 54,400,000 |

| 14. | iSON Xperiences | Media & Entertainment | 1 | 51,000,000 |

| 15. | Reliance Health | Healthcare & Pharmaceuticals | 3 | 48,000,000 |

| 16. | 54Gene | Healthcare & Pharmaceuticals | 4 | 44,650,000 |

| 17. | Wakanow | Travel & Leisure | 1 | 40,000,000 |

| 18. | PalmPay | Financial Services | 1 | 40,000,000 |

| 19. | MAX.ng | Transport & Logistics | 8 | 39,200,000 |

| 20. | Kobo360 | Transport & Logistics | 5 | 37,320,000 |

| 21. | Migo | Financial Services | 5 | 37,138,000 |

| 22. | Vendease | E-commerce & Retail | 2 | 33,200,000 |

| 23. | Paga | Financial Services | 4 | 32,700,000 |

| 24. | iROKOtv | Media & Entertainment | 3 | 30,000,000 |

| 25. | Starsight | Energy & Environment Resources | 3 | 29,200,000 |

| 26. | uLesson | Education | 4 | 25,600,000 |

| 27. | Rensource | Energy & Environment Resources | 4 | 24,580,000 |

Google recently rolled out the list of 60 eligible black-founded African startups joining its Startups Black Founders Fund (BFF) for Africa. 23 Nigerian startups unsurprisingly were on the list.

Earlier this week, Nigeria had the highest number of startups selected for the Techstars Toronto 2022 Winter cohort.

This points to one thing: Nigeria remains the dominant country in Africa’s startup space. With a large youthful population and a growing talent pool, Nigeria is certain to hold sway in the African tech ecosystem for a long time.

Llew Claasen, managing partner of South Africa-based venture capital firm Newtown Partners puts it better: “Nigeria’s startup ecosystem….holds exciting opportunities for the future.”

How other ‘Big 4’ countries fared

While Nigeria holds the top spot of most funded African startups with 27, Kenya — the tech hub of East Africa — is second on the list with 23 startups. The rise of the Kenya tech ecosystem has been remarkable in the last few years, spurring the growth of startups now gaining global appeal and attracting venture funding.

A 2020 report shows that Kenya was among the top four African countries by value invested through venture capital investment. TechCrunch recently reported that Kenya had recorded the greatest growth in funding this year, as the country’s startups raised nearly $1 billion dollars in the first half of 2022.

South Africa is third on the list of countries with the most-funded startups in 2022, with 19 startups. If anything, the dominance of South African companies in the African tech landscape is something to watch. According to Disrupt Africa’s 2022 South Africa Startup Ecosystem Report, the country’s startup ecosystem leads the way in exit mergers and acquisitions (M&As).

Between January 2015 and May 2022, 357 individual South African startups also raised a combined US$993,684,600. Last month, South African startup Talk360 raised an additional $3 million seed funding.

Egypt, the last of the Big 4, has 15 startups in the top 100, but none made it to the top 10 of most funded African startups. The highest-ranked Egyptian startup is MNT Halan, at 19th with $127m in total funding. Undoubtedly, Egypt has established itself as an African tech hub to be reckoned with. As of September 2021, at least 562 tech startups were operating in the North African country. However, the Egyptian tech ecosystem is still in the works, albeit with some challenges.

No Comment! Be the first one.