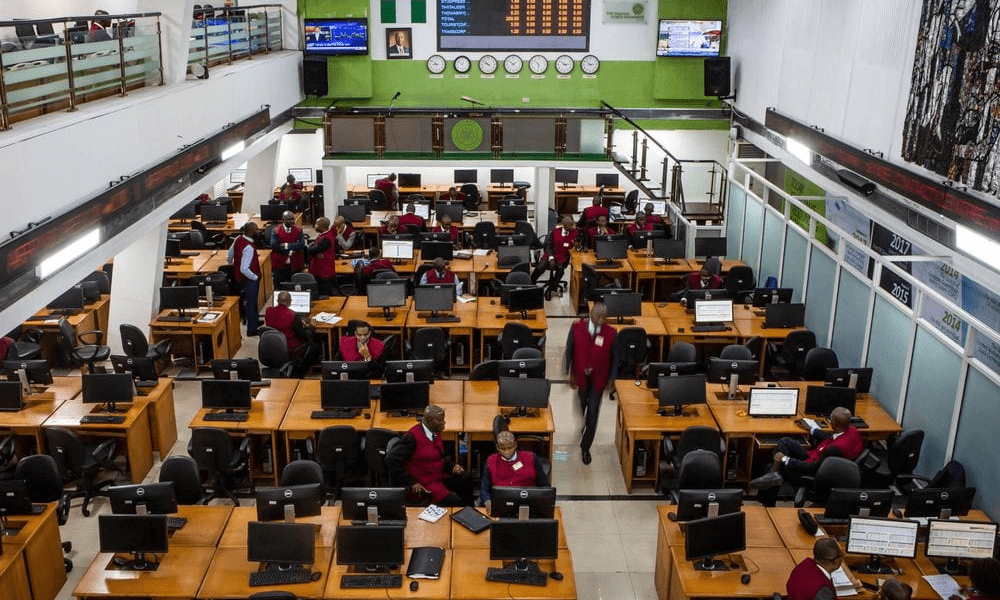

Nigeria’s Stock Market Capitalisation Hits ₦100 Trillion for the First Time in History

Nigeria’s equities market has recorded a historic milestone, with market capitalisation crossing the ₦100 trillion mark for the first time ever, underscoring renewed investor confidence and strong...

Nigeria’s equities market has recorded a historic milestone, with market capitalisation crossing the ₦100 trillion mark for the first time ever, underscoring renewed investor confidence and strong momentum at the start of 2026.

The milestone was achieved on January 5, 2026, following a sustained rally that lifted total equity value from ₦99.90 trillion to ₦101.5 trillion, driven by broad-based gains across mid- and large-cap stocks.

Market performance at a glance

The rally was reflected in the Nigerian Exchange All-Share Index (ASI), which surged by 2,725.8 points or 1.74%, closing at 159,218.2 points, up from 156,730.7 points in the previous session.

This performance brings the ASI within touching distance of the 160,000-point psychological level, supported by strong buying interest and multiple stocks hitting the 10% daily gain limit.

What the data shows

The market’s 1.74% daily gain highlights growing investor optimism, pushing the year-to-date return to 2.32%.

Top gainers included NSLTECH, Champion Breweries, Fidson Healthcare, May & Baker, and PZ Cussons, all recording the maximum 10% daily price appreciation.

On the losers’ chart, Juli and Ikeja Hotels led declines, shedding 9.93% and 9.91%, respectively.

Trading activity improved, with Tantalizers and Zenith Bank leading volumes at 71.7 million and 53.3 million shares traded.

Zenith Bank also dominated transaction value, posting ₦3.5 billion, followed by WAPCO (₦2.5 billion) and Aradel (₦1.5 billion).

Strong showing from market heavyweights

The session revealed renewed appetite for large-cap and trillion-naira stocks.

Among the SWOOTs (Stocks Worth Over One Trillion Naira):

Aradel advanced 7.18%

International Breweries gained 6.67%

Nigerian Breweries climbed 4.28%

In the FUGAZ banking group, performance was equally strong:

Access Holdings surged 8.7%

Zenith Bank gained 3.88%

GTCO rose 5.09%

UBA added 6.63%

Top five gainers

NSLTECH: +10% to ₦0.88

CHAMPION: +10% to ₦15.40

FIDSON: +10% to ₦60.50

MAYBAKER: +10% to ₦20.90

PZ: +10% to ₦49.50

Top five losers

JULI: -9.93% to ₦7.26

IKEJAHOTEL: -9.91% to ₦40.45

SUNUASSUR: -4.55% to ₦5.25

SOVRENINS: -2.36% to ₦3.72

BERGER: -2.08% to ₦47.00

Why this matters

Crossing the ₦100 trillion market capitalisation threshold is a major psychological and economic milestone for Nigeria’s capital market. It signals resilient investor sentiment, improving liquidity, and broad-based participation across key sectors such as banking, consumer goods, and energy.

The rally also suggests that institutional investors are returning after the holiday period, setting a positive tone for market activity in early 2026.

What to watch next

The strong performance follows a solid close to 2025, driven by gains in consumer goods, insurance, and industrial stocks. Analysts expect increased scrutiny of dormant and underperforming equities in the coming weeks as investors hunt for value opportunities.

Market outlook

With the ASI firmly above 159,000 points and market capitalisation above ₦100 trillion, momentum remains positive. If buying pressure is sustained across large- and mid-cap stocks, the market could extend its rally, with the 160,000-point level emerging as the next upside target.

No Comment! Be the first one.