Top Authors

Popular Posts

ATCON Leadership Visits NCC, Strengthens Collaboration on QoS and Underserved Areas

NCC Calls for Stakeholder Input on Review of National Telecommunications Policy 2000

MTN’s $6.2bn IHS Deal Faces Federal Government Review Amid Telecom Monopoly Concerns

African Countries With The Highest Interest Rates in May 2025

May 26, 2025

As inflation and currency volatility persist across Africa,...

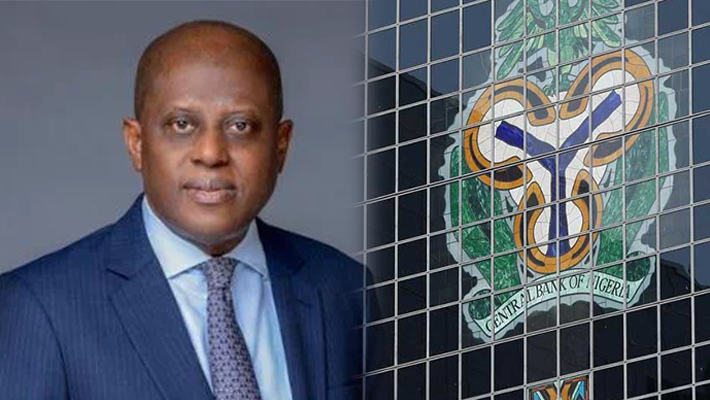

CBN Bans Banks And Fintechs From International Money Transfers

February 3, 2024

The ban comes amid the apex bank’s resolve to maintain...

Why We Sacked the MD’s of Union, Titan, Keystone And Polaris Banks – CBN

January 11, 2024

The Central Bank of Nigeria has dissolved the entire Board of...

Bank CEOs, Others in Merger, Acquisition Talks

November 26, 2023

Indications emerged on Saturday that the chief executive...

7 Things to know about new CBN Governor, Cardoso

September 16, 2023

President Bola Ahmed Tinubu approved on Friday the nomination...

Nigeria’s Apex Bank Mandates Financial Institutions to Obtain Customers’ Social Media Handles

June 25, 2023

Financial institutions have been mandated by the Central Bank of...

10 Day After Supreme Court Ruling, CBN Okays Use of Old Naira Notes

March 14, 2023

Ten days after Nigeria’s Supreme Court ruled that the N200, N500...

CBN Names Isa Abdulmumin as New Spokesperson

February 26, 2023

The Central Bank of Nigeria (CBN) has appointed Isa Abdulmumin...

Naira Redesign: Evaluating the Effectiveness of CBN’s Communication

February 23, 2023

There is a popular theory that Nigerians are resilient. The CBN...

BREAKING NEWS! Supreme Court Fixes March 3 for Judgement on New Naira Note

February 22, 2023

The Supreme Court on Wednesday adjourned judgement in the new...