Top Authors

Popular Posts

14 Million Farmers to Benefit as AfDB, IITA Launch $16.6m Climate-Resilient Agriculture Initiative

Galaxy Backbone Strengthens Nigeria’s Paperless Civil Service With 150,000+ Official Emails

MTN Nigeria Becomes NGX’s Most Valuable Company at N16 Trillion

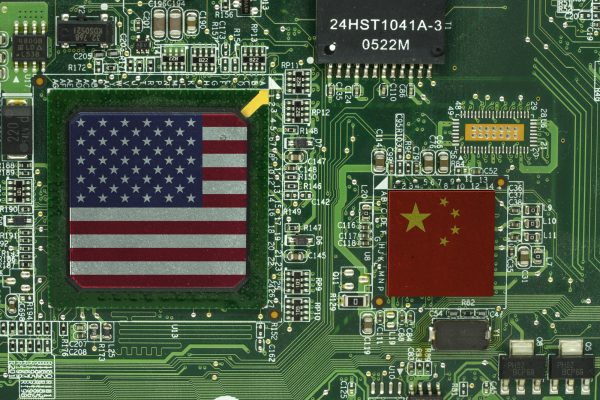

US Chip Makers Hit by New China Export Rule

September 3, 2022

Shares of major chipmakers Nvidia and AMD have fallen amid...

Investment Flow to Africa Reached a Record $83 Billion

August 30, 2022

European investors remained by far the largest holders of...

Think Tank Calls for US Industrial Policy to Combat China’s Quest for Tech Dominance

April 6, 2021

If the United States wants to out-compete China in key...