Nigeria Remains 3rd Most Attractive Investment Destination in Africa

South Africa leads the pack with a total score of 88, followed by Mauritius with 76, while Nigeria retains the third spot with 69. Africa’s largest economy, Nigeria unsurprisingly remained one of the...

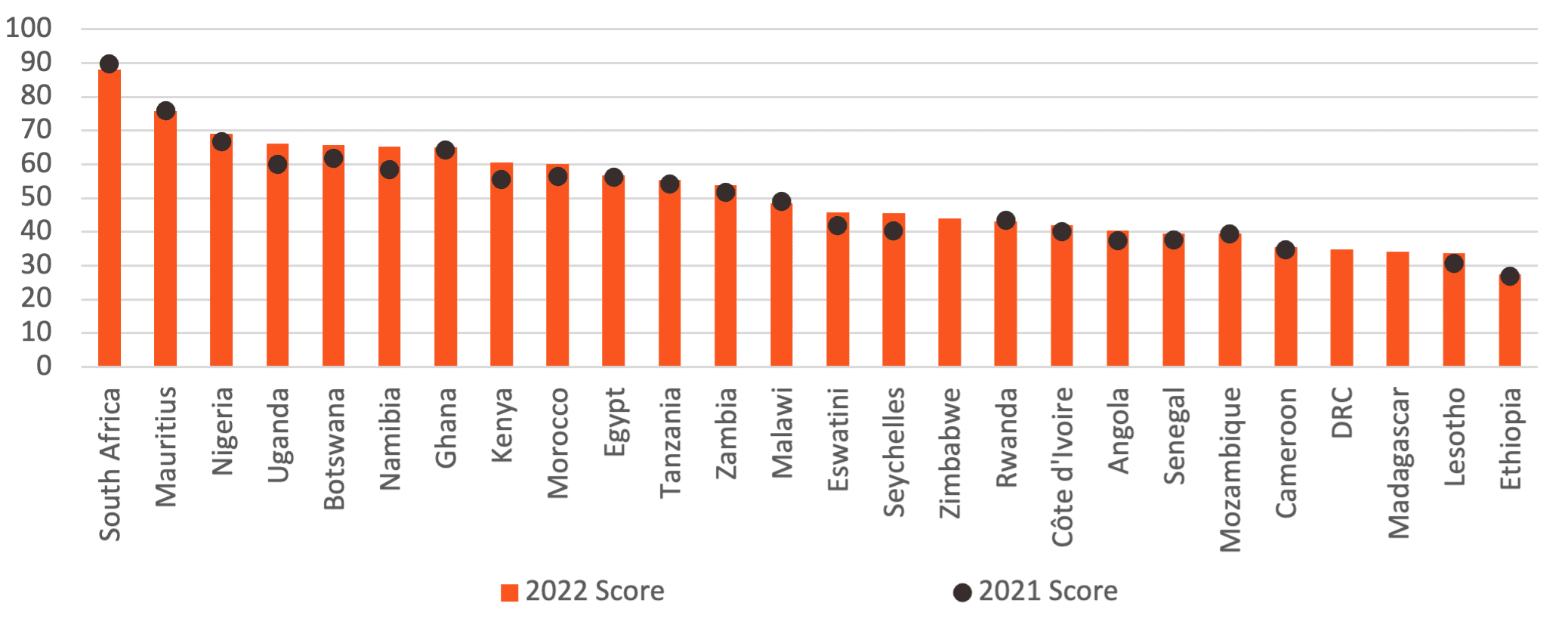

South Africa leads the pack with a total score of 88, followed by Mauritius with 76, while Nigeria retains the third spot with 69.

Africa’s largest economy, Nigeria unsurprisingly remained one of the top 3 nations with the most developed financial sector in the continent, according to the 2022 Absa Africa Financial Markets Index (pdf) released by Absa Bank and the Official Monetary and Financial Institutions Forum (OMFIF).

This comes amidst the economic woes facing Nigeria which its president Muhammadu Buhari recently blamed on “economic saboteurs”.

Using six pillars, the Absa index assesses 26 African countries to identify those with the most favourable market environments. The pillars include market depth; access to foreign exchange; market transparency, tax and regulatory environment; capacity of local investors; macroeconomic opportunity; and enforceability of financial contracts.

Per last year’s index, Nigeria retained its spot as the third most attractive country in Africa for foreign investment in 2021. With a total score of 63/100, the report described Nigeria as an “attractive regulatory and market environment”.

This year, the feat repeated itself, as the top 3 nations, according to the 2022 index include South Africa, Mauritius, and Nigeria. This is because they continue to rank highly in terms of market size, transparency, and the ability to enforce contracts.South Africa leads the pack with a total score of 88, followed by Mauritius with 76, while Nigeria retains the third spot with 69.

“Despite macroeconomic headwinds, advances in sophistication, depth and transparency of African capital markets represent a considerable plus. A range of African countries now leads the field in key spheres. In one prime example, Africa has forged ahead in meeting requirements from investors targeting economic sustainability,” – OMFIF chair David Marsh said in the report.

A closer look

In the six pillars used in the survey, Nigeria scored 58 in market depth, 67 in access to foreign exchange, 85 in market transparency, tax and regulatory environment, 27 for capacity of local investors, 78 in macroeconomic opportunities, and 100 for legal standards and enforceability — which the report ascribes “to wider use of standard master agreements following legislative reforms in 2020.”

When compared with last year’s numbers, this represents a growth, which is however hardly surprising.

The Nigerian capital market, for one, has continued to grow in leaps and bounds. In H1 2022, the Nigerian Exchange Limited (NGX) was ranked as the 4th best-performing index globally, according to Bloomberg.

At the close of trading on Wednesday, the market capitalization rose from N₦24.39 trillion reported on Tuesday to ₦24.43 trillion, representing a 0.15 per cent rise of ₦39.02 billion.

What is responsible for this growth?

According to the Absa report, a number of reasons have helped Nigeria retain its spot as one of the top financial market leaders in Africa. The International Swaps and Derivatives Association (ISDA) also acknowledged Nigeria’s progress in recent times.

In August 2021, Nigeria became only the third country in the index to receive a clean netting opinion from the New York-headquartered trade organization, Also in August 2021, the Nigerian Securities and Exchange Commission (SEC) introduced a regulatory framework for Robo-advisory services.

According to Statista, assets under management in the Robo-Advisors segment are projected to reach $2.22 billion in 2022.

Last October, the Central Bank of Nigeria (CBN) introduced its central bank digital currency, the eNaira to make financial transactions easier and boost Nigeria’s economy. One year since its launch, the eNaira has recorded 700,000 transactions worth ₦8 billion, though its adoption is still relatively low.

In April this year, the NGX launched West Africa’s first Exchange Traded Derivatives (ETD) Market with Equity Index Futures Contracts, alongside the listing of two Equity Index Futures Contracts, NGX 30 Index Futures and NGX Pension Index Futures.

But for Nigeria to displace South Africa to become the most attractive destination for investment in Africa, the country must first address its worsening economic situation.

As prescribed by an Abuja-based think tank, deft economic management, strong political will and effective communication are some of the solutions the Nigerian government should consider.

No Comment! Be the first one.