Global Fintech Funding Drops By 38% in Q3

The total value of investments into fintech companies worldwide dropped by 38 per cent in the third quarter of 2022, according to the State of Fintech Report for Q3 2022 released by CB Insights last...

The total value of investments into fintech companies worldwide dropped by 38 per cent in the third quarter of 2022, according to the State of Fintech Report for Q3 2022 released by CB Insights last month.

This new data reflects a continued decline in fintech funding. Global economic uncertainties and growing inflation concerns have forced most investors to hold on to their capital.

Largely, 2022 has been a rough year for fintechs. Global fintech funding reached an all-time high last year with a whopping $210 billion raised across a record 5,684 deals.

According to the latest report, a total of $12.9 billion was raised across 1,160 deals in Q3 2022, representing a 64% drop year-over-year (YoY). It further revealed that this quarter is the sector’s weakest since Q4 2020, bringing the total raised by fintech companies this year to $63.5 billion.

In Q1, $29.7 billion was raised in 1,524 deals, Q2 saw $20.9 billion raised in 1,280 deals, implying that fintech funding dropped by 33% quarter-over-quarter (QoQ).

Key highlights

Some of the key highlights of the report include the following:

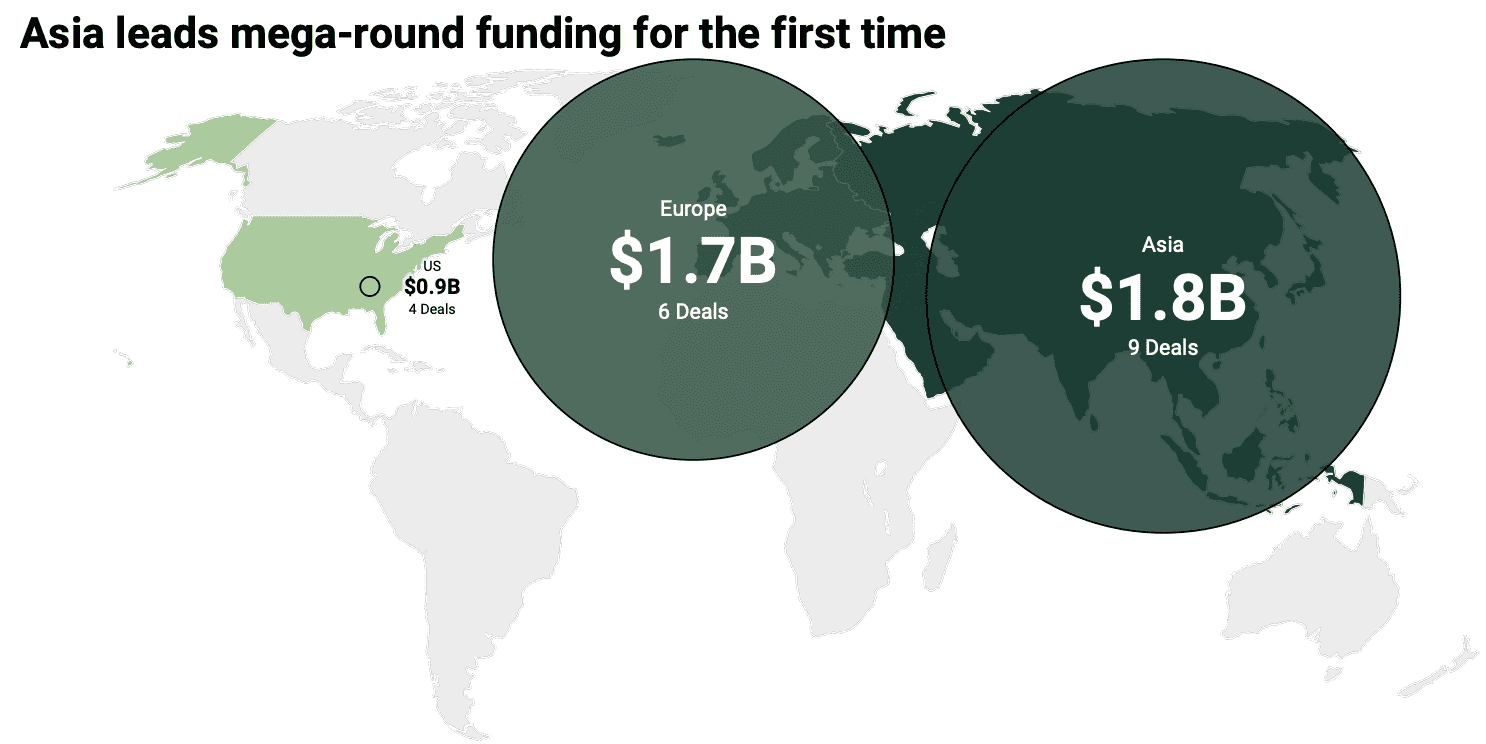

- Only 19 mega-rounds worth $100 million were recorded in Q3 2022, which is said to be the fewest since Q2 2018. This figure means the average deal size was down 38% from the full year (FY) 2021. Also, fintech mega-rounds only accounted for 34% of total funding, compared with an average of 66% recorded in 2021.

- For the first time since Q4 2018, Europe surpasses the US in late-stage deal share, drawing 32% of deals, while the US brought in 24%.

- The fintech space birthed 6 new unicorns in Q3 2022, falling below double digits for the first time since 2020. All regions also saw a decline in quarterly unicorn births.

- In Q3 2022, fintech merger and acquisition (M&A) exits declined by 14% QoQ to 155 deals, an 8- quarter low.

- Across all fintech segments, Insurtech recorded the smallest QoQ decline, dropping just 4% from $2.4 billion to $2.3 billion.

Asia is the new challenger to watch out for

Surprisingly, Asia had the best run in Q3 2022, a look at the regional trends showed. Asia took the lead in mega-round funding for the first time ever, drawing US$1.8 billion in nine deals, followed closely by Europe with $1.7 billion in six deals.

On the other hand, the US witnessed a downturn in numbers, recording only four deals worth $900 million. However, the US still led the world in regional deal share (39%) and total funding sum ($5.1 billion).

In late-stage deal share, Asia drew 33% of deals, ahead of Europe and US with 32% and 24%, respectively. Also, in payments — which led the global fintech funding landscape in Q3 2022 — Asia raised $1.6 billion across 49 deals. Notable rounds included Dana’s $555 million Series A, Toss’s $371 million Series G, and OneCard’s $100 million Series D.

Trailing behind Asia is Europe, with $1.1 billion in 35 deals, while the US raised $1.0 billion across 66 deals.

Interestingly, Asia’s impressive run isn’t surprising. Venture capital investments in Asia Pacific-based fintechs surged to a record high of $15.69 billion in 2021, meaning the sector remains a hot cake for the region.

Recently, Hong Kong was listed among the top fintech ecosystems in the world, citing its number of fintech-focused accelerators and incubators and funding. In 2021, the Chinese city produced two fintech unicorns: ZA and Amber Group. In May this year, it added another: Babel Finance.

How did Africa fare?

With its relatively young ecosystem, Africa also had a fair share of the drop in global fintech funding in Q3 2022. According to the report, Africa raised $161 million across 43 deals in the third quarter. Compared with Q2 2022 numbers, this represents a 58% decline and 30% drop in QoQ. A hardly shocking figure since venture funding in Africa fell by 54% in the third quarter.

However, in what may be considered good news, Africa’s early-stage deal share climbed to a record 90% in 2022 year-to-date (YTD), a new high compared to 88% and 81% recorded in 2021 and 2020, respectively.

Q3 2022 also saw Africa witness some interesting equity deals. Notable among them are Nigerian startup, TeamApt’s $50 million Series B, South African biometrics start-up iiDENTIFii’s $15 million Series A and another Nigerian fintech startup, NowNow’s $13 million raise.

By company count, the top investors are Mauritian venture capital firm Launch Africa with 4, Seychelles’ Huobi Ventures with 3, while Tunisian private equity firm AfricInvest had 2 deals.

Despite the global decline and homegrown political and economic challenges, the African fintech ecosystem is poised to record exponential growth in the coming years. Global management consulting firm McKinsey estimates that Africa’s financial-services market could grow at about 10 per cent annually, reaching about $230 billion in revenues by 2025.

The momentum of recent years can be capitalized on by several African countries, especially those where cash is still used for most transactions.

No Comment! Be the first one.