Samsung Dominates Global Smartphone Market as Apple Maintain Second Spot

According to a recent report released by Canalys, an IT-research-focused company, Samsung currently leads the smartphone market globally with a 22% market share. Apple and Chinese Xiaomi complete the...

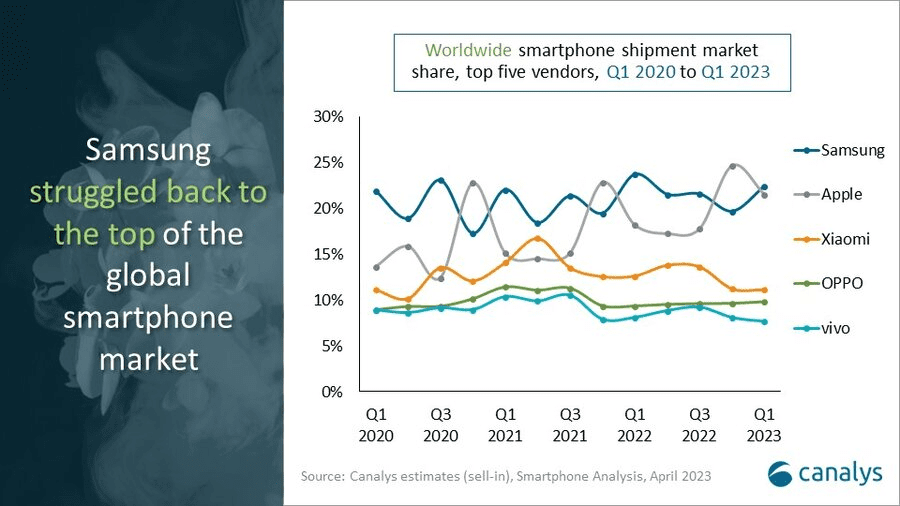

According to a recent report released by Canalys, an IT-research-focused company, Samsung currently leads the smartphone market globally with a 22% market share. Apple and Chinese Xiaomi complete the top three spots with a 21% and 11% market share, respectively.

The reports, which give a quarterly and yearly update on the global smartphone shipment based on market demand and supply, noted that Samsung was the only leading vendor to achieve a quarter-on-quarter recovery and struggled back to number one with a 22% market share.

Meanwhile, Samsung’s major competitor, Apple, narrowed the gap after a resurgence brought by the increased demand for its latest product, the iPhone 14. Apple remained in second place with a 21% market share driven by solid demand for its iPhone 14 Pro series in Q1 2023.

Xiaomi held on to and completed the top three position with an 11% market share, helped by new product launches toward the end of the quarter while inventory adjustment continued. OPPO and Vivo strengthened their positions in the Asia Pacific region and their home markets, accounting for 10% and 8% of the market share, respectively.

Other than that, the global smartphone market experienced a fifth consecutive quarter of decline, falling by 12% year-on-year in Q1 2023. Despite limited improvements in major unfavourable macro factors, the market is yet to recover.

“The smartphone market’s decline in the first quarter of 2023 was within expectations throughout the industry,”

said Canalys Analyst Sanyam Chaurasia.

Smartphone market’s declining demand

As per our previous analysis of the smartphone market, 2022 ended on a shaky note for the global smartphone market as shipments dropped by 18.3% year over year to 300.3 million units in the fourth quarter of last year, according to the Worldwide Quarterly Mobile Phone Tracker, released by the International Data Corporation (IDC), a global market intelligence provider.

Per the report, which provides insightful analysis through quarterly market share data by region, the drop represents the largest-ever decline in a single quarter. It also contributed to a steep 11.3% decline for the year.

This was also closely followed by the 9.7% year-over-year decline to 301.9 million units in the third quarter of 2022, per previous data from the IDC Phone Tracker. The smartphone market ended that year with shipments of 1.21 billion units, representing the lowest annual total since 2013.

That trend has continued into 2023, with smartphone makers Samsung and Xiaomi losing some of their market shares in the first quarter of 2023. According to the report by Canalys, Samsung saw a fall in market share, going from 24% in Q1 2022 to 22% in Q1 2023. In Q1 2023, Xiaomi, which ranks third internationally in smartphone market share, dropped from 13% to 11%.

“The local macroeconomic conditions continued to hinder vendors’ investments and operations in several markets. Despite price cuts and heavy promotions from vendors, consumer demand remained sluggish, particularly in the low-end segment due to high inflation affecting consumer confidence and spending.”

Additionally, the continuous sluggish end-user demand has triggered a major wave of destocking across the entire supply chain, with channels reducing inventory levels to secure operations. To maintain a low level of sell-in volume, vendors continued to use cautious production techniques, which had a long-term negative impact on the component supply chain’s operational performance”, she added.

Market resurgence expected?

Toby Zhu, a Canalys Analyst, stated that there had been increases in demand for specific smartphone brands and price ranges while noting that there have been some signs of stabilization in the ongoing fall.

“There have been improvements in demand for certain smartphone products and price bands. Furthermore, some smartphone vendors are becoming more active in production planning and ordering components.

Canalys predicts that the inventory of the smartphone industry, irrespective of channel or vendor, can reach a relatively healthy level by the end of the second quarter of 2023. It is still too early to predict the recovery of overall consumer demand. However, the sell-in volume of the global smartphone market is expected to improve due to the reduction in inventories in the next few quarters.

In addition, vendors have focused more on innovations and raising production and channel efficiencies after a round of fluctuations, shifting from growing for volumes and shares to growing for quality. 5G popularization and foldable phones are also becoming the new driving forces in the industry.“

The smartphone market is anticipated to experience a greater supply of 5G phones with the global rollout of 5G, which would further generate a pool of inventory. Although it is still unclear, this pool or influx of supply may also result in a price drop for some of these devices or even a further reduction in shipment if the current macroeconomic conditions persist.

However, if you like to get one, you can check out this story for some of the cheapest 5G smartphones available to Nigerians.

No Comment! Be the first one.