Top Authors

Popular Posts

ATCON Leadership Visits NCC, Strengthens Collaboration on QoS and Underserved Areas

NCC Calls for Stakeholder Input on Review of National Telecommunications Policy 2000

MTN’s $6.2bn IHS Deal Faces Federal Government Review Amid Telecom Monopoly Concerns

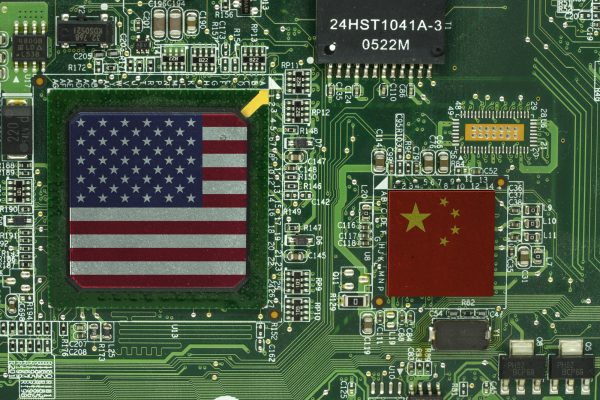

Chip Wars: Will Cell Phone Take The Laptop Crown?

November 7, 2023

As industry leaders in chip manufacturing vie for supremacy,...

US Escalates Tech Battle by Cutting China Off AI Chips

October 18, 2023

The Biden administration is reducing the types of semiconductors...

Europe Joins the US in its Chip War with China

Europe’s biggest producer of advanced chipmaking technology has...

US-China Chip War: Major Microchip Firm Says China Employee Stole Data

February 17, 2023

Major computer chip equipment maker ASML says a former employee...

US-China Chip War: How the Technology Dispute is Playing Out

December 17, 2022

The US is rapidly ramping up efforts to try to hobble...

US Chip Makers Hit by New China Export Rule

September 3, 2022

Shares of major chipmakers Nvidia and AMD have fallen amid...