Telecoms, Breweries Top Gainers As 2023 Elections Drag Nigeria’s Stocks – Experts

As the processes for the 2023 general elections gather momentum, and flagbearers of parties emerge, the blossoming Nigeria’s capital market may be hard hit over a possible change of government and...

As the processes for the 2023 general elections gather momentum, and flagbearers of parties emerge, the blossoming Nigeria’s capital market may be hard hit over a possible change of government and increasing insecurity in the country.

The market has appreciated marginally since the beginning of the year, reaching a 13-year high. As a result, the All-Share Index(ASI) rose by 24.55 per cent to 53,201.38, from January 1 to June 10.

The market capitalisation also inched up higher, gaining approximately N7.38 trillion to N28.68 trillion respectively, raising positive sentiments among investors as quoted companies declared sumptuous first-quarter earnings with the hope of better performances in the second quarter.

New data released recently, equally shows that Nigeria beats South Africa, Ghana and other stock markets to rank best performing in Africa.

“Companies’ half-year results give hope to the investing public that at the end of the year, they will still have something to share with their shareholders,” said the National Coordinator of the Progressive Shareholders Association, Mr Boniface Okezie.

But as the Independent National Electoral Commission(INEC) tightens up against election uncertainties, many fear the 2023 general elections will negatively impact the domestic bourse.

According to experts, the uncertainties and inevitabilities may puncture the booming capital market and lead to more exits of foreign investors.

Recent data published by the Nigerian Exchange Limited(NGX), shows that foreigners accounted for just 23 per cent of Nigerian equity trading last year, down from more than 50 per cent in 2015.

“Good dividends will still come the way of investors with little capital appreciation from their equities. But my fears are that foreign investors are definitely going to leave, during and after the election because of insecurity.

“What is already happening in the country is nothing to cheer about, plus Nigeria’s elections are always marred by thuggery and violence. This is going to affect the economy in a bad way if care is not taken,” Okezie told our correspondent.

There is also anxiety around what stocks are likely to be the destination for the mass of investors.

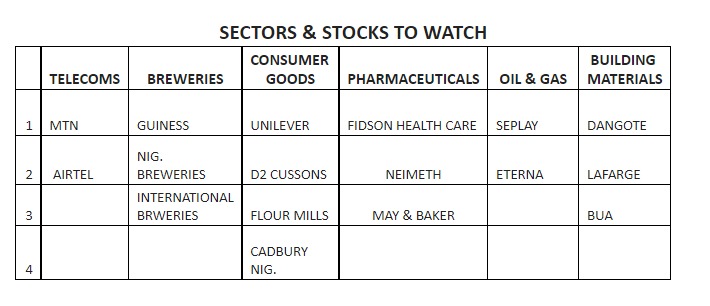

Abel Ezekiel, an Investment and Portfolio Analyst, told insidebusiness.ng that the majority of investors might tilt towards the shares of telecommunications, breweries, consumer goods, pharmaceuticals and oil and gas companies.

He expects the shares of MTN Nigeria Communications and Airtel Africa to take the lead in the telecoms sector while Guinness, Nigerian Breweries and International Breweries steer the path in the breweries.

Unilever Nigeria, PZ Cussons Nigeria, Flour Mills of Nigeria and Cadbury Nigeria will likely be the choicest stocks in the Fast-Moving Consumer Goods (FMCG); while Fidson Healthcare, Neimeth International Pharmaceuticals, May & Baker Nigeria in the pharmaceuticals.

Ezekiel added that under the oil and gas sub-sector, the shares of Seplat Petroleum Development Company and Eternal may lead the pack, while in the building materials, Dangote Cement, Lafarge Wapco and BUA Cement could race head-on to be investors’ delight.

On his part, Okezie said companies with sound fundamentals, in terms of good dividend delivery, will remain attractive to investors, noting notwithstanding, the economic headwinds and the global market outlook in general.

“These factors are not ruled out entirely,” he said. The banks’ first-quarter results, if anything to go by, are all looking positive.

Telecoms

Explaining the reasons why these stocks will delight investors, Ezekiel said, “The telecoms is a sector that drag and influence or enhances the activities in other sectors, be it banking, aviation, oil and gas and everywhere digitalisation is making ease of doing business better.

“All these culminate in using data and voice calls, licensing of Payment Service Bank(PSB) and 5G license for both MTN and Airtel, which are already being deployed. This will ultimately stimulate more growth and boost the bottom-line for these organisations.”

Airtel Africa, which is the most capitalised company on NGX, is presently at about N6.6 trillion, more than the banks’ shares put together and MTN at about N5.6 trillion capitalised stock, he noted.

“All the banks currently have a total capitalisation of about N4 trillion. So, I see mass patronage of investors in this sector (telecoms) as their business expansion and growth continue to soar in leaps and bounds,” he added.

Breweries

With the worldwide and nationwide improvement of health and safety from the horrendous Coronavirus disease, there has been a marked improvement in social gatherings and activities, which has positively enhanced the earnings of companies in the breweries sector, hence all the operators are posting a huge profit as seen in their Q1 results, and much anticipated Q2.

In fact, the full-year report of Guinness which has had a huge year-to-date capital appreciation of over 127 per cent will any moment from July/August hit the market after the massive results of Q1, Q2, Q3, Ezekiel explained.

“The Q4 result, with all intent and purpose, will not be an exception, hence the company which share price started the year at about N32 hitting the year-to-date height of N110, before dropping to N90.50, due to activities of profit-takers, is surely a good buy for a discerning investor looking for a fundamental sound stock.

“Same for others like Nigerian Breweries, International Breweries, which has suddenly recovered from over four years of declaring losses will certainly be a place to earn good capital appreciation if they keep up the positive momentum in the much anticipated Q2 report that will soon be made available to the investing public,” he asserted.

FMCG

These are companies involved in the essential household products which are consumed daily no matter the state or purchasing power, generally referred to as ‘Growth Stocks’, doing even better in recession.

The companies enjoy unadulterated patronage, employed or not, and naturally are not seriously affected by the economic crisis.

“No wonder Okomu Oil Palm and Presco have given investors much joy this year and I am expecting a bumper harvest of excellent earnings reports moving forward into the near future. And certainly, any investor who patronises this company based on their sound and currently healthy financial report will not regret their decision.

“So, I am confident mass movement of them is much expected. Therefore, their earnings are solid, hence most of them had enjoyed capital appreciation within the last three months. This includes Cadbury from an all-time low of N7.7 to currently N17; PZ from N6 to almost N13 at present. Unilever and others have not done badly either as the stocks had improved in dividend payment as well,” Ezekiel said.

This positive trajectory is expected to continue which in turn will spur investors to seek their securities massively.

Pharmaceuticals

This sector will remain vibrant and dominant as the world looks for drugs and pharmaceutical products to roundly deal with the deadly Coronavirus Disease.

“As the fear and aftermath effect is yet to be fully recovered, so I strongly believe this will lead in boosting their earnings and as such investors are expected to buy their shares to partake from their goodies,” Ezekiel also said.

Stocks and 2023 elections Fear

Also, analysts are jittery that uncertainties over the 2023 general elections would further push the exit of foreign investors from the Nigerian capital market.

According to Okezie, if the general elections go well, and credible candidates emerge in a free and fair election, surely the outcome of the election will go a long way to affect the market outlook in a good direction.

But, if INEC and the politicians fail to abide by the rule and go-ahead to scuttle the will of the people (electorates) then the economy will be in danger, “A serious one for that matter,” Okezie warned.

He stressed further that the outcome may not be favourable to the local investors, not to talk of foreign investors, leaving the markets in droves.

“So, we must get it right in looking for a good economy after the 2023 postmortem election,” he said. “Certainly in any general election cycle investors’ apathy is real and germane.”

He noted that recent insecurity across the states of the federation, especially in the northern and eastern parts of Nigeria with the kidnapping of citizens as well as foreigners, was even worse than election fears as most investors would not want to invest where lives and properties are less secured.

“However, with the emergence of less controversial, more tolerant, business-minded and investors’ friendly aspirants, who know the consequences of plunging the country into election violence, I am sure they will conduct their election activities in a very investors’ friendly manner as aspirants, and by so doing they will de-risk the investment environment.

“I am so convinced the trio of Atiku Abubakar, Peter Obi and Bola Tinubu are “businessmen politicians”, who will attract investors before and after the election. So, most investors who may want to leave or have left will surely come back by virtue of their peaceful and investor-friendly policies and disposition,” Ezekiel said.

He asserted that there may not be any serious consequence the exit of foreign investors may have on the domestic market.

In mitigating any effect or backlash, he added, “The withdrawal of foreign investors may be taken over by domestic investors as much as earnings reports are robust and good

No Comment! Be the first one.